While it’s much more complicated than that, in case you need a short overview of what marketing budget in eCommerce looks like in one sentence, this would be it:

A well allocated eCommerce marketing budget is a fine balance between investing in new customer acquisition and retaining the existing customer base (churn rate reduction).

In a dynamic world of selling online, you’ll need to readjust your budget quite often, much more often than once per year like a lot of companies do. This is probably easier for smaller companies but with a good organization and data driven decisions made by observing the right KPIs and proper attribution it can be done on a very large scale as well.

In eCommerce, marketing budget allocation should be decided by observing the following KPIs:

Customer Acquisition Cost

- By acquisition channel

- By time based cohorts

- Conversion rate by channel and cohort

Churn Rate

- By acquisition channel

- By time based cohorts

Customer Lifetime Value (ideally by profit margin)

- By acquisition channel

- By time based cohort

Allocating budget into new customer acquisition

Let’s start this section by helping you avoid doing one of these 3 common mistakes of new customer acquisition budget allocation:

1. Never put all of your eggs in one basket.

It’s easy to calculate CAC (customer acquisition cost) for a certain acquisition channel so it’s very easy to figure out which channel is cheapest in terms of CAC and invest all of your money into that channel.

That is extremely risky. If something happens to that channel you are in a big problem.

For example, if one was investing all of their marketing budget in advertising on a certain platform, what happens to their business if the platform loses audience? What if the platform changes rules and you’re no longer able to advertise there? What if the CAC on that platform skyrockets and you can no longer afford advertising on it?

Another example would be companies relying 100% on SEO and organic traffic from search engines. If one invests all of their budget over there what happens if Google’s next change of algorithm knocks you out of page one? Sometimes Google even introduces new features into their result pages that can literally destroy entire industries and not just individual websites.

All of these situations would be very tricky for your business and this is why it’s not advisable allocating your entire marketing budget into just one best performing customer acquisition channel even though it makes more financial sense to do so, you need to consider risk management.

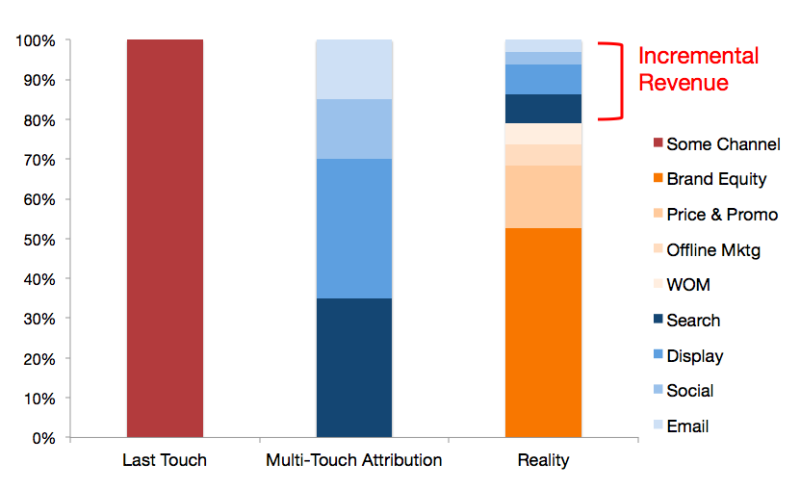

2. Misattribution

When people think of acquisition channels they usually calculate conversion using just one of the attribution models and that’s usually the last click attribution.

Different channels play role in a conversion and you cannot observe the acquisition channel’s effectiveness through last click attribution model.

Even default Google Analytics offers a lot of options for different attribution model comparisons where you can see which role each channel plays depending on how you attribute conversions.

There’s so much written about attribution modeling by people far smarter and much more experienced in that field than me that googling it would open your eyes to a few hundred years worth of reading material. That’s why I won’t write a lot about this.

I will, however, point you towards this article which has this amazing image that will open your eyes to how much misattribution happens when you’re attributing a sale to just one channel that brought you the last click before conversion:

3. It’s not CAC that’s important, it’s CLV

Don’t concentrate on customer acquisition cost when determining the effectiveness of an acquisition channel. Concentrate on customer lifetime value of customers acquired through that acquisition channel while taking into consideration the CAC.

For example, your Google shopping ads might have a much lower customer acquisition cost than your Facebook ads, but after digging much deeper into the data, you might discover that customers acquired through Facebook ads have a significantly larger customer lifetime value.

The most effective acquisition channel for your new customers is not the one with the lowest CAC, but the one that has the highest CLV – CAC.

Once again, when calculating channel’s CAC, beware of misattribution!

Rough guidelines for new customer acquisition budget allocation

First of all, I must warn you that different eCommerce websites with different target audiences and products they’re selling have very different optimal marketing budget allocations.

For this reason it is impossible to tell you exactly how much you should be investing into which channel. I will give you some rough guidelines here that might be a good starting point to set but after that make sure you observe the KPIs I told you about earlier and readjust your marketing budget allocation accordingly as often as possible to achieve the best possible results.

According to a research from 2014, this is how an average eCommerce businesses allocate their marketing budgets for customer acquisition:

- Paid search: 14% to 20% of total marketing budget

- SEO: 11% to 12% of total marketing budget

What? Where’s the rest of the budget? Well, not entire eCommerce marketing budget goes into new customer acquisition. Some goes into other things we’ll talk about a bit later. Also note that this article where the data comes from didn’t cover other channels, just these two top ones. It did cover a topic of PLA (3% to 5% of budget) but it’s very unclear if those are already included into the 14% to 20% that goes into paid search since PLA is basically just one aspect of paid search.

Anyway, it doesn’t really matter. Whatever you allocate you’ll probably change the percentages as soon as you start observing some trends in your KPIs and it’s a waste of time trying to get it right from the start as your budget allocation is supposed to shift significantly all the time as you measure and change according to data.

Some other things you should try adding into your new customer acquisition mix right from the start should be: social networking, Facebook ads, and affiliate marketing.

Reducing the new customer acquisition cost

The new customer acquisition cost can be reduced and optimized in two ways:

1. By optimizing the marketing budget allocation and investing more in channels with lower CAC (but keep in mind not to overdo it and beware of mistake number one mentioned above in the article)

2. By improving the new customer’s conversion rate

The conversion rate optimization is a topic on its own. There are lots of resources about it and it’s out of scope of this article to go into it in detail. The tools we recommend for conversion rate optimization on an eCommerce website are either Optimizeley or Visual Website Optimizer.

Both of these platforms will enable you to conduct split testing experiments that will help you lower the customer acquisition cost.

This is not something you do once and you’re don with it, it’s much more of a never ending process much like SEO, social networking, or content marketing.

You’ll find many things to test but concentrate on the things that will impact your conversion rate the most such as you main call to actions (usually add to cart, proceed to checkout, place order buttons), your cart page, and your checkout process. Split test different versions to see what works best for your customers.

Allocating budget into churn rate reduction

The definition of churn rate is:

The percentage of subscribers to a service that discontinue their subscription to that service in a given time period.

Unless you’re selling a subscription through your eCommerce website, you don’t really have a churn rate in terms of that definition, but you do have returning and new customers.

Since returning customers are usually much easier to sell to (lower acquisition cost) it’s often worth investing in bringing your old customers back or increasing the customer retention rate. In the other words, we could call this the eCommerce churn rate reduction.

There are different ways you can reduce the eCommerce churn rate. The most important thing to do is to evaluate why did some group of your customers stop buying from you. Or in the other words:

Try to determine common characteristics of churned customers and correlation of those characteristics to churn rate compared to non churned customers from the same churn stage within the acquisition channel and time based cohort.

By understanding their motivation to no longer buy a certain product or to no longer buy it from you, you can figure out what’s the best incentive you can give them to continue buying the product from you. It’s an investment, usually in form of a special discount just for them, or other types of offers where you need to set a part of your budget for retaining those repeat customers.

In non subscription based eCommerce (especially B2C which is the most common one), it’s very hard to figure out when the user should be considered a churned user. In subscription based business, when someone cancels the subscription we consider him churned and thus it’s pretty simple, but with non-subscription eCommerce, it’s hard to define when a repeating customer should be considered churned. Is it XYZ days after the last purchase? Is it a month after the last purchase?

There are a few blog posts that tackle that issue, but most of them end up with the same conclusion that I’d like to paraphrase:

When a user will be considered a churned user is different for each eCommerce business. You need to figure it out for your user base and draw an arbitrary line in the sand that you’ll be using for calculations.

Figuring out when to invest in new customer acquisition and when in churn rate reduction

If CAC in certain acquisition channel and cohort is 8 and CLV in the same channel and cohort is 10, we aim to determine how much would it cost us to reduce the churn rate of that cohort and channel by 1% and how much would that mean for our CLV, meaning we’re calculating if it’s more affordable to invest into churn rate reduction or into new customer acquisition at this given time.

If 1% churn rate reduction means +1 to our CLV, this would mean that each new customer in that cohort would now be worth 11. If 1% churn rate reduction would cost us 100, we need to calculate how many customers we need in our customer base for us to be more beneficial to invest in churn rate reduction than in customer acquisition.

Current total customer lifetime value of the observed cohort:

1000(customers in cohort)*10(CLV)=10000(total value)

New total customer lifetime value of the observed cohort:

1000(customers in cohort)*11(CLV)=11000(total value)

Since our CAC is 8, for 100 we could acquire 12.5 customers. Since we’ve moved that budget from customer acquisition to churn rate reduction, we need to remove 12.5 customers from our new total customer lifetime value of the observed cohort and channel. This brings us to the following calculation:

987.5(customers in cohort)*11(CLV)=10862.5(total value)

This means that under conditions where we have 1000 customers in a given cohort and our CAC is 8, CLV is 10 and an investment of 100 yields a +1 on cohort’s CLV, investing in churn rate reduction of 100 would yield 862.5 more profit than investing the same 100 into new customer acquisition.

By now, you’ve probably noticed that determining weather you should invest in new customer acquisition or in churn rate reduction depends on the size of the cohort.

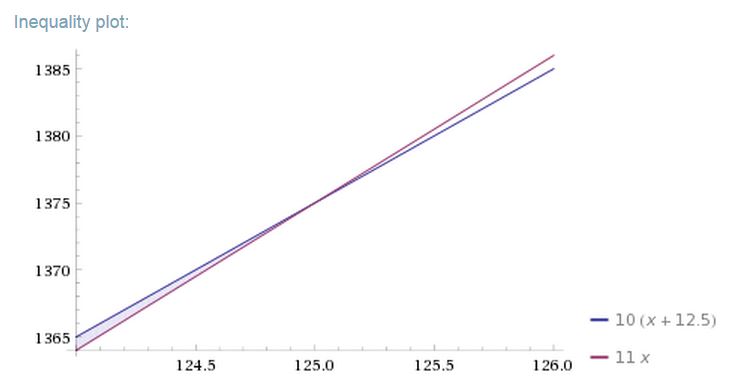

So, in our case, we have the following formula that will show us when it’s more efficient to invest in churn rate reduction and when in new customer acquisition for a given cohort:

(x+a)*CLV1>CLV2x

Where “x” is our cohort size that we’re looking for, “a” is the amount of customers we can acquire with the investment, “CLV1” is customer lifetime value if we invest in new customer acquisition and “CLV2” is customer lifetime value if we invest in churn rate reduction.

If we input our numbers into this inequality we get:

(x+12.5)*10>11x

Which means that as long as the cohort size is larger than 125 in our case, it’s more efficient to invest in churn rate reduction than in new customer acquisition.

Needless to say, prerequisite for doing any of these calculations is to collect quality data.

If you require any help with this, you can always contact us.