Amazon is a leading retail eCommerce company with a US market share of almost 40% in 2022. At the same time, Google is the biggest search engine, with 93% of the search engine market share worldwide. Unsurprisingly, both companies have an advertising platform that plays a massive role in the online advertising market. We decided to share the knowledge learned from our experience providing eCommerce PPC Services. In this article, we’ll touch on key differences in how advertising works on each platform, and the pros and cons.

Auctions and ranking factors

AMAZON: Like Walmart and other advertising platforms, Amazon uses a “second-price auction.” This means that the advertiser pays a slightly higher amount than the second-highest bid instead of paying the full bid amount when someone clicks on the ad.

But that doesn’t mean the highest bid wins 100% of the time. Amazon’s algorithm also calculates which ads are most relevant to the shopping query and eligible to be displayed. However, a high bid can make your ad more competitive or even compensate for lower-quality ads.

GOOGLE: On the other hand, Google is much more transparent about its auction system. We have all heard of “Ad Rank,” the metric used by Google to determine Ad position in Google search results and CPC that the advertiser pays for a click on their ad. Ad Rank combines CPC bid and Ad quality, but other things also matter, like search context, ad extensions, and format. Google earns from advertising by ad clicks. That’s why it makes sense that CTR plays a huge role in determining the rankings besides Ad relevance.

PPC influence on organic ranking

AMAZON: You can do SEO for Amazon product listings perfectly, but you probably won’t rank or rank highly without PPC campaigns to support it. Why is that so? Suppose you launch a new Amazon product with high-level SEO and a visual listing presentation, but how will you make your first sale if you are not ranked? How will customers find your product? PPC is your only real opportunity to move the needle and start selling. With PPC, you simulate a high organic ranking, increase your visibility, CTR, and sales rate, and ultimately increase your organic ranking.

Sales history is undoubtedly Amazon’s most important ranking factor. Whether the sales come from organic, PPC, or external sources is sales history. In addition to ad clicks, Amazon makes money from product sales, so it makes sense that they rank higher products that sell more.

GOOGLE: Here, the situation is the opposite. As Google stated, Investment in paid search does not impact your organic search ranking. Google maintains a strict separation between our search business and our advertising business. In a broader sense, PPC efforts can help build brand awareness and reach new customers. It will likely positively affect your organic traffic and rankings in the long run, but there is no direct connection.

And that’s a big difference between the two advertising platforms. With wise and quality On-Page and Off-Page SEO tactics, you can raise your organic traffic and rankings to the first page of Google without any PPC. The same is likely impossible in today’s highly competitive Amazon market.

Advertising objectives

AMAZON: That may seem pretty simple, but let’s go deeper into it. The primary goal of Amazon PPC is to drive sales of the listed products. It is a key aspect of any new product launch as it increases product visibility, and conversions, improving organic rankings. But in addition to being used to launch and sell products, PPC is the foundation of any long-term strategy for Amazon sellers.

Suppose you stop investing in advertising. Your competitors won’t, and you can be pretty sure of that. Over time, they will gain more visibility on search result pages than you, resulting in more sales. More sales will signal the algorithm to improve its organic rank, possibly to your detriment.

GOOGLE: The goal of Google advertising campaigns varies depending on the advertiser’s primary goal. Google enables advertisers to pursue various objectives, such as increasing website traffic, brand awareness, generating leads or sales, promoting products or services, and more.

Key performance metrics

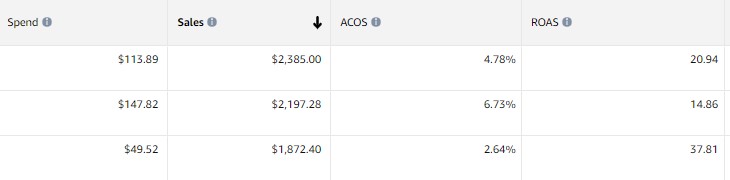

AMAZON: In addition to standard eCommerce PPC metrics, when evaluating the performance of Amazon advertising, it is necessary to consider some platform-specific metrics such as TACoS and ACoS.

TACoS stands for the total advertising cost of sale and measures advertising spending against total revenue. That is one of the most important performance indicators for any Amazon business.

Good TACoS (below 20% for most niches) suggests that sales mostly come organically. Let’s say you spent $1,000 on ads, and your total revenue (organic + ads + external) is $10,000. That means your TACoS is 10%.

ACoS (advertising cost of sale) measures the cost of advertising in relation to the revenue that comes from ads. With ACoS, we measure the effectiveness of a specific advertising campaign, and we can think of it as the opposite of ROAS. If the ads spent $500 brought you $1,000 in sales, your ACoS would be 50%, and your ROAS would be 2.

Amazon’s ACOS metric

GOOGLE: It depends on advertising goals and targeted network on what KPIs you should focus on with Google. Besides standard PPC metrics like CTR, avg. CPC, Conversions, and others, for most eCommerce businesses, key metrics to track are ROAS, CVR, Conversion value, and Cost per conversion. Since you cannot track ROAS for non-eCommerce websites, you should likely focus on CPA (cost per acquisition) or View rate, avg. CPM (average cost per thousand impressions), EVC (Engaged-view conversions), and others if you ran YouTube ads.

Ad network & targeting options

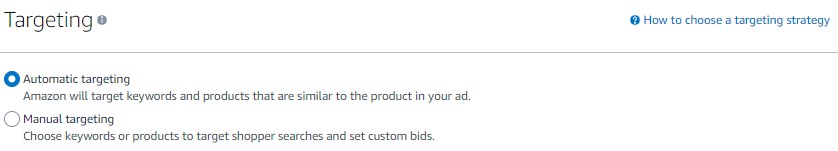

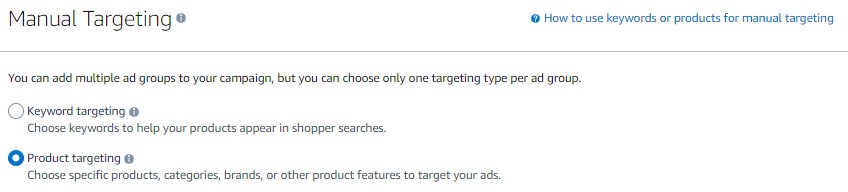

AMAZON: On the Amazon platform, ads appear within search results pages, product detail pages, and other placements across the platform, depending on the ad format. In addition to KWs and different Audinaces, Amazon offers some platform-specific targeting options like Product targeting and Auto targeting. Product targeting helps advertisers target specific products, categories, or brands. Auto-targeting advertisers let the algorithm decide where and when to place ads based on the keywords it identifies from the listing.

GOOGLE: Google Ads covers a broader range of platforms, including search, display, video, and mobile app ads. Google also offers a wider range of targeting options to reach a broader audience on different platforms. They include some platform-specific options like targeting specific locations, content placements, and topics. It’s also possible to schedule advertising based on the time of day or device the customer is using, options that Amazon currently lacks.

Amazon targeting options

Bidding strategies

AMAZON: Because of their different platforms and advertising goals, Amazon and Google have different approaches when it comes to bidding strategies. Amazon Ads does not offer fully automated bidding strategies like Google. Instead, manual bidding includes automatic bid adjustment features that can dynamically raise and lower bids for you based on the likelihood of a conversion. You can also adjust bids by placement, whether you want to target the TOP of search placement or product pages.

GOOGLE: On the other hand, Google offers some fully automated, smart bidding strategies such as Target CPA, Target ROAS, and Maximize Conversions. These strategies use machine learning algorithms to automatically optimize bids based on historical data, conversion likelihood, and contextual signals. Google will automatically set bids for you and optimize based on the goals and performance of your campaigns. That significantly simplifies campaign management since there is no need to optimize bids manually.

Conclusion

As the e-commerce industry grows, Amazon is rapidly increasing its market share. The fact that almost 50% of all eCommerce purchases in the US in 2022 happened through Amazon sounds incredible. While this may sound exciting, businesses should be cautious when entering the Amazon marketplace.

Good margins are key to maintaining profitability. Depending on the seller’s method, Amazon charges different fees for each item sold which will not benefit your margin. Reviews play a key role in increasing CTR and CVR, and it will take you some time to reach a relevant number of them. We mentioned the importance of PPC for launching a new product and as part of a long-term strategy, which is another significant blow to margins.

Finally, add to this aggressive competition that will attack your newly created listing without social proof. You will understand why launching a new Amazon product can be extremely expensive, especially in highly competitive niches. However, if your budget can handle all those initial investments and fees, things could go well for you. Amazon is a marketplace with high purchase intent, and the conversion rate is almost double that of Google, providing a great opportunity to increase sales volume in ways other platforms cannot match.

On the other hand, Google is great for building brand awareness. You don’t have to pay anything other than advertising costs, getting more out of every sale. Since it is primarily a search engine, many users who search on the platform do so for research purposes only. They may click on an ad, but on average, the purchase intent is significantly lower compared to Amazon. As we mentioned earlier in the article, SEO and PPC are separated on Google, making achieving high visibility and organic ranking easier without investing in advertising.